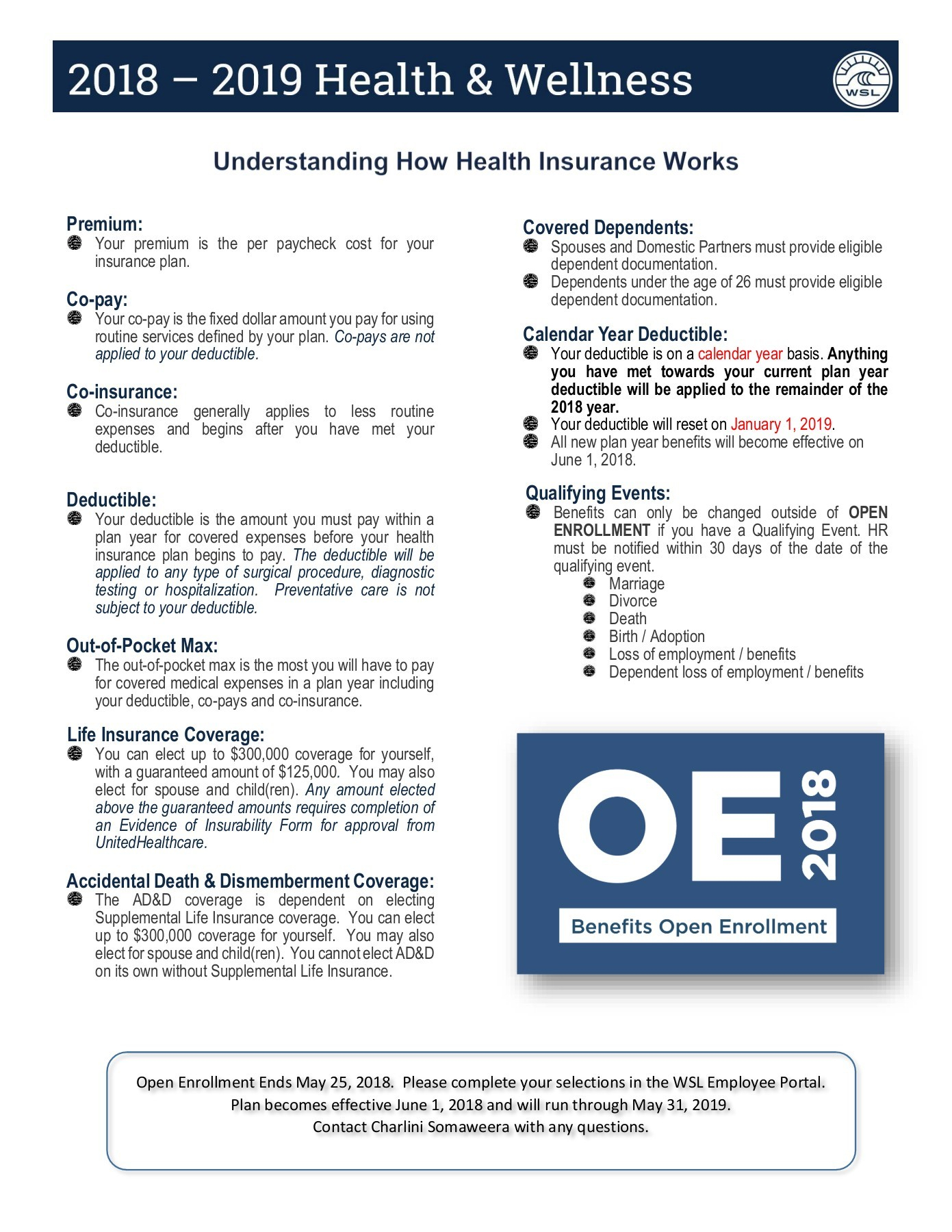

Calendar Year Medical Deductible. In health insurance, the deductible works on an annual basis, and after your new policy year begins, the running total of what you've paid will reset to zero. For example, if a health insurance policy has a $2,000 deductible per calendar year, the.

Your annual deductible is typically the amount of money that you, as a member, pay out of pocket each year for allowed amounts for covered medical.

canonprintermx410 25 Best Who Do I Pay My Health Insurance Deductible To, The most common deductible reset date is january 1st, which aligns with the start of the new calendar year. For example, if you have a $1000 deductible, you must first pay $1000 out of pocket before your insurance will cover any of the expenses from a medical visit.

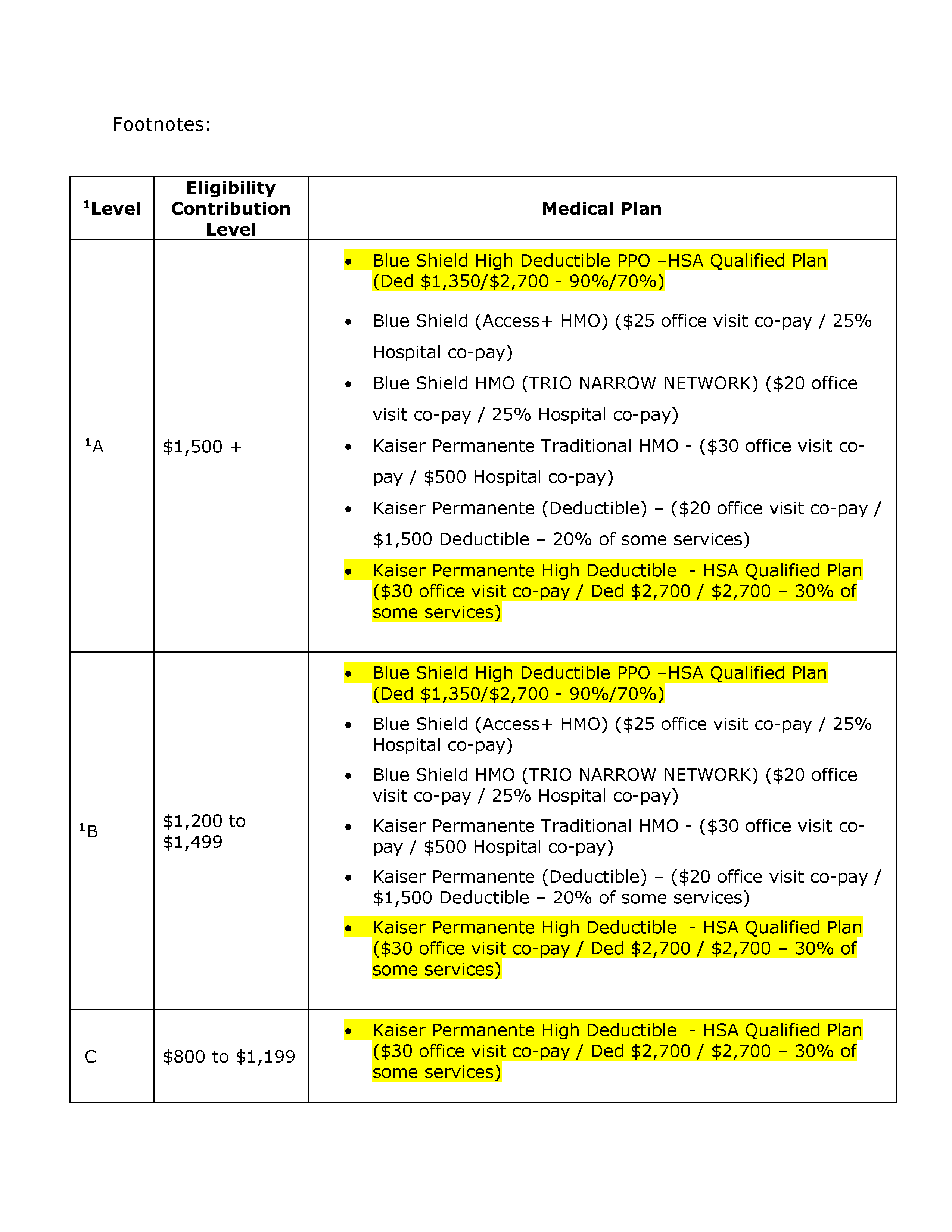

Deductibles, CoPay and Out of Pocket Maximums, The aetna high deductible health plan (hdhp) with a health savings account (hsa) will increase its deductible for individuals from $1,500 to $1,600 and for families. The deductible year usually begins on january 1st and ends on december 31st.

What Is A Medicare Benefit Period and Calendar Year?, For instance, an annual deductible might be $2,000 per calendar year, meaning the insured would need to pay this amount in medical expenses each calendar. All individual plans now have the calendar year match the plan year, meaning no matter when you buy the plan,.

canonprintermx410 25 Unique How Is The Deductible Paid In Health Insurance, Once you've met your deductible, you'll generally no longer need to pay another deductible until the next calendar year. Here’s what it actually means:

21+ Hsa Contribution Limit 2025 Article 2025 BGH, These accounts are run on a calendar year, since the irs limits how much money you can put away each year. Understanding the difference between a benefit period.

Insurance 101 New Year, New Deductible — Sound Speech and Hearing, These accounts are run on a calendar year, since the irs limits how much money you can put away each year. The deductible limit is the maximum amount covered in a given year a participant may have to pay before the plan coverage is required to satisfy the full.

A Calendar Year Deductible Calendar Printables Free Templates, For example, if you have a $1000 deductible, you must first pay $1000 out of pocket before your insurance will cover any of the expenses from a medical visit. Here’s what it actually means:

Medigap Plan G Cost Compare Rates for 2025, For example, if you have a $1000 deductible, you must first pay $1000 out of pocket before your insurance will cover any of the expenses from a medical visit. Updated on october 18, 2025.

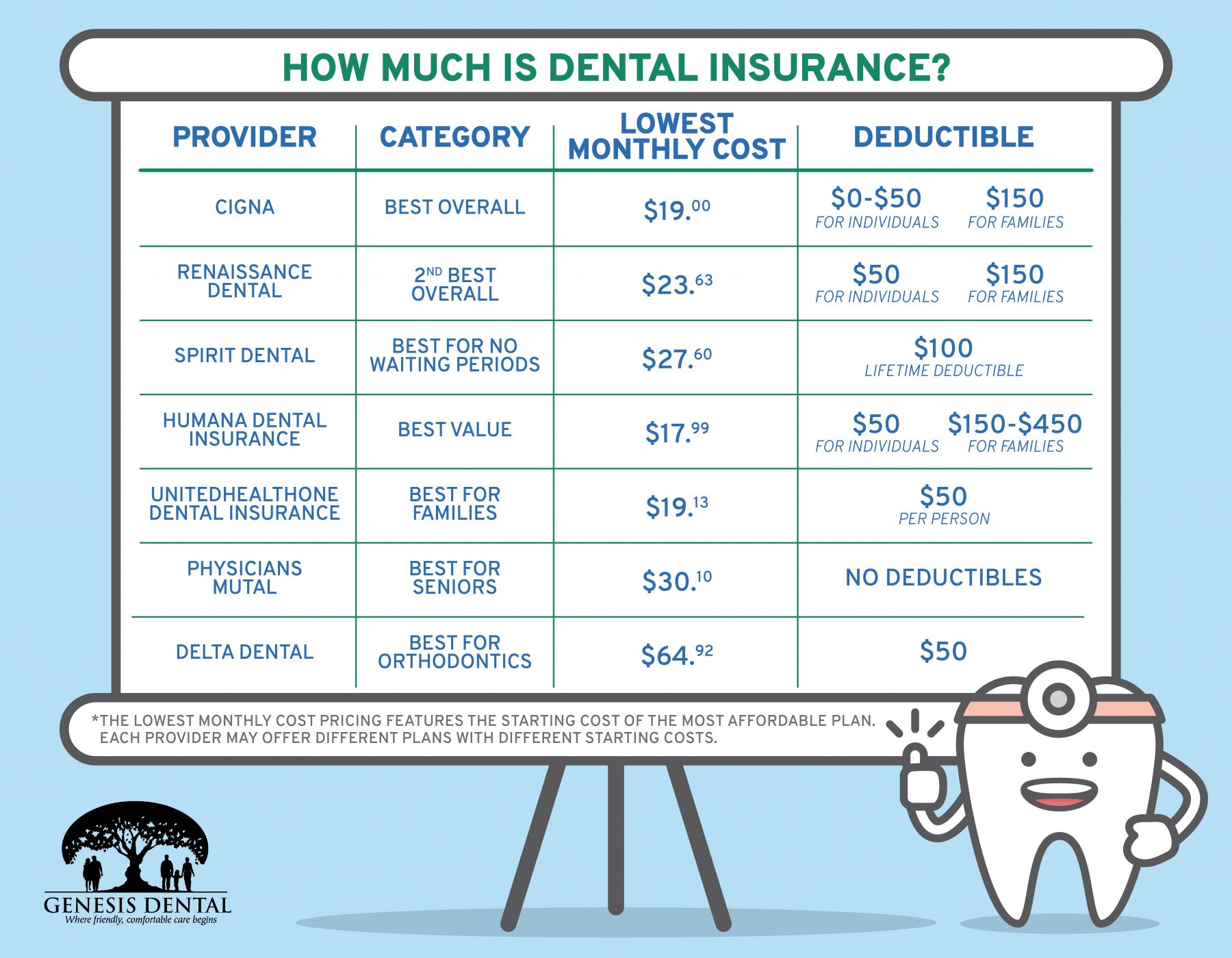

How Much is Dental Insurance? Genesis Dental Utah & Kansas Dentist, The deductible year usually begins on january 1st and ends on december 31st. For example, if a health insurance policy has a $2,000 deductible per calendar year, the.

H&W Health Savings Accounts and High Deductible Plans 47 Blog AFM, This deductible is typically based on a per calendar year timeframe. In 2018, the contribution limit for fsas is $2,650.

The deductible limit is the maximum amount covered in a given year a participant may have to pay before the plan coverage is required to satisfy the full.